Corporate governance

The Listing Rules of the UK Listing Authority require listed companies to disclose how they comply with the principles of good governance and code of best practice

known as the Combined Code (the ‘Code’). The latest version of the Code was issued in June 2008.

The revised UK Corporate Governance Code, which was issued by the Financial Reporting Council in June 2010 (the ‘New Code’), will apply to the Company in

respect of the financial year ending 31 March 2012. The Board has reviewed the requirements of the New Code, and is implementing a number of changes over the

forthcoming year to ensure compliance with the new provisions. The revised code is publically available at www.frc.org.uk.

This statement explains how the Company has applied the principles of good governance set out in the Combined Code.

The Board

During the year UK Mail maintained a balance of executive and non-executive directors, bringing a wide range of skills and experience to the Board. Biographical

details of the current directors are set out on page 16.

The Combined Code states that the Board should determine whether a director is independent in character and judgement and whether there are relationships or

circumstances, which are likely to affect or could appear to affect, the director’s judgement, for example serving on a board for more than nine years, or has had a

material business relationship within the last three years.

Of the five non-executive directors that served on the Board during the year, Trevor Jenkins and Michael Findlay are judged to be independent according to the

guidelines set out in the Combined Code. They are considered by the Board to be independent in character and judgement and having no relationships which are

likely to affect, or could appear to affect, the directors’ judgement. Bill Cockburn previously had a consultancy agreement which included incentives in relation to

the performance of UK Mail. These incentives vested in May 2008, with payment of his entitlement shortly thereafter. Bill’s role since that time has been solely as

a non-executive director. The board has evaluated Bill’s judgement and character, and his performance since that date, and have satisfied themselves that Bill

Cockburn acts as an independent director. Michael Kane, who retired from the Board on 1 July 2010, and Peter Kane are not judged to be independent due to their

significant shareholdings. All the non-executive directors make a significant contribution to the functioning of the Board and its committees, and no one individual

or group dominates the Board’s decision-making process.

Peter Kane (who was appointed as a director on 1 April 2001) and Bill Cockburn (who was appointed as a director on 1 April 2002), both having now served on the

Board for more than nine years, are required under the provisions of the Code to submit themselves for re-election each year.

All other directors are required by the Company’s Articles of Association to submit themselves for re-election at least every three years or, in the case of any person

appointed by the directors as a director during the last year, such director is required to submit themselves for re-election at the next Annual General Meeting. The

names of those directors standing for election/re-election to the Board this year are set out in the Notice of the forthcoming Annual General Meeting. There are two

non-executive directors and one executive director standing for re-election at the AGM and the Board strongly supports their re-election for the reasons set out in the

Directors’ Report.

The Company’s policy is that Executive Directors may take no more than one non-executive directorship of another company, and any such involvement must be

subject to the Board’s prior approval. Steven Glew currently has such an appointment, details of which are set out in the Remuneration Report.

The Board’s focus is on strategy formulation, policy and control. There is a formal schedule of matters reserved for decision by the Board which retains all major

operational and risk management decisions with the Board. These include the approval of major items of expenditure or commitment, including acquisitions; major

operational projects, including new contract wins; financing, including lease/buy decisions and the use of derivatives and insurance; and changes in policy relating

to the franchise network. The Board routinely monitors the various financial, operational and commercial risks facing the Company through reports from management.

The Chairman is primarily responsible for the working of the Board, and the Chief Executive for the running of the business and implementation of Board strategy and

policy. There is a clear division of responsibilities between the Chairman and the Chief Executive and this has been agreed by the Board. The Board meets formally

at least ten times a year, with other meetings as necessary. The Board receives reports in advance of each meeting from the Chief Executive and Finance Director

addressing the financial performance of the Company and developments since the previous meeting, with further reports on particular issues as appropriate. Reports

are also supplied to directors in months when a Board meeting does not take place. All directors have access to the advice and services of the Company Secretary,

and there is a procedure whereby directors, wishing to do so in the furtherance of their duties, may take independent professional advice at the Company’s expense.

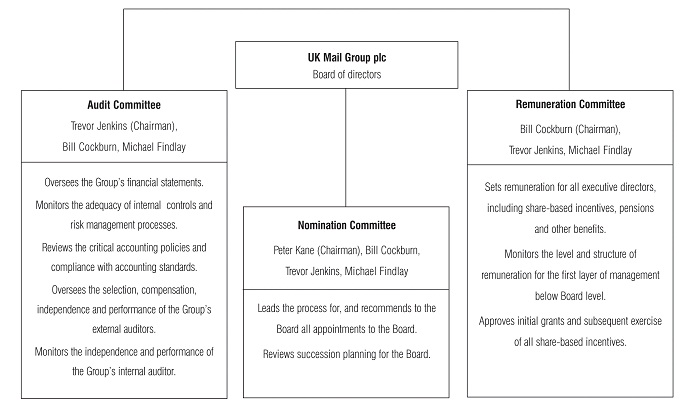

The Board has a number of committees, the principal ones being the Audit, Remuneration and Nomination Committees. Membership of these committees as at May

2011 and their principal terms of reference are set out in the next page.

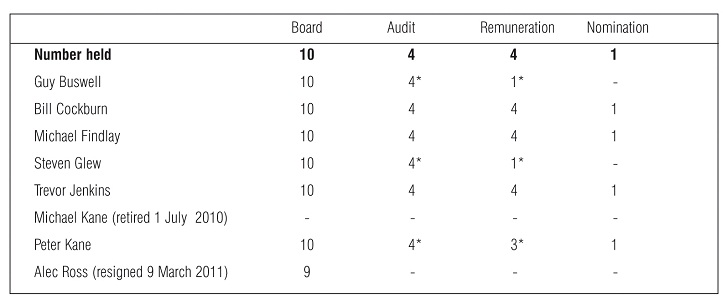

The following table shows the attendance of directors at regular Board meetings and at meetings of the Audit, Remuneration and Nomination committees during the year.

* Attendance by directors who are not members of the committee was at the request of the Chairman of the committee.

The Nomination Committee meets as necessary to consider the size, composition and structure of the Board, and succession planning. The Nomination Committee plays

a key role for appointments to the Board in agreeing the principal job description, appointing independent recruitment consultants and interviewing the preferred candidates.

The Nomination Committee met once during the year.

The directors have again reviewed the effectiveness of the Board as a whole and its committees. The individual directors initially completed separate questionnaires, and

the results were compiled and analysed by the Company Secretary, who prepared a summary report for the Board. The areas covered included Board and committee

composition, dynamics and accountability; preparation for and performance at meetings; and induction and professional development.

In addition to regular Board meetings, the Chairman regularly convenes meetings of the non-executive directors to assess the performance of the Board in the absence of

the executive directors. Furthermore, the performance of the Chairman was discussed separately by the non-executive directors without the Chairman present. Overall, the

Board and its committees are satisfied that they are operating effectively.

New members of the Board receive appropriate training and induction which includes spending time in the company’s operations. On an annual basis, the Chairman reviews

and approves individual directors’ training plans.

Full details of the work of the Audit Committee and the Remuneration Committee can be found on pages 24 and 30.

Directors’ remuneration

The Board considers that the Company complies with the main principles of the Combined Code in relation to remuneration, by having a formal and transparent

procedure for developing policy on executive remuneration and for fixing the remuneration packages of directors. No director is involved in deciding his own

remuneration. A significant proportion of remuneration is structured so as to link rewards to corporate and individual performance. The Board believes that levels of

remuneration are sufficient to attract, retain and motivate directors of the quality required to run the Company successfully, but without paying more than is necessary.

Details of directors’ remuneration are set out in the Remuneration Report.

Relations with shareholders

Whilst there is a substantial shareholding represented on the Board, the Company values its dialogue with both institutional and private investors. Two-way

communication with institutional investors, analysts and private investors is actively pursued, and a series of presentations and meetings are held throughout the year,

carefully recognising statutory constraints concerning the disclosure of information. Feedback from these meetings is collated by the Company’s advisers and

circulated to members of the Board to ensure that they are kept informed concerning the views of shareholders. In addition, the Chairman periodically attends meetings

with shareholders, and non-executive directors are invited to attend results presentations.

This year’s Annual General Meeting will be held on 13 July 2011 at which time the chairmen of the Audit, Remuneration and Nomination Committees will be available

to answer shareholder questions. The Company will continue its practice of proposing individual resolutions, including separate resolutions relating to the Directors’

Report and Accounts and the Remuneration Report, and of reporting the proxy voting in respect of each resolution.

Internal controls

The Board of directors has overall responsibility for ensuring that the Group maintains a system of internal control to provide it with reasonable assurance regarding

effective and efficient operations, internal financial control and compliance with laws and regulations. There are inherent limitations in any system of internal control

and, accordingly, even the most effective system can provide only reasonable, and not absolute, assurance.

The Turnbull report, as revised in October 2005 by the Financial Reporting Council, provided further guidance as to how the Combined Code principles on internal

control should be applied in practice.

The Board considers that the Company has complied with the Turnbull report throughout the year. There is a formal ongoing process for identifying, managing and

reviewing any changes in the risks faced by the Company. This process operates under the direction of, and is regularly reviewed by, the Board who is satisfied with

the level of effectiveness of the internal control system.

The key features of the internal control system within the Group are:

- clearly defined delegation of responsibilities, including relevant authorisation levels;

- clearly documented internal procedures set out in operational and administration manuals;

- regular compliance audit visits to all owned and franchised locations which monitor compliance with procedures and assess the integrity of financial information;

- review of financial procedures by the internal auditor;

- close involvement of executive directors in monitoring and managing the main risk areas of the business;

- regular information provided to senior management, covering financial performance and key business indicators; and

- monthly monitoring of results against budget and forecast, with major variances being followed up and management action taken where necessary.

Details of the Group’s activities in relation to its environmental, employment and health and safety responsibilities are set out in the Corporate Responsibility statement.

The Board has reviewed the effectiveness of the internal control systems during the period covered by the accounts and up to the date of the approval of the accounts.

This review covered all controls, including financial, operational and compliance controls and risk management. No significant findings were identified which required

action to be taken.

Compliance with the Combined Code

The Board considers that the Company has complied with the provisions of Section 1 of the Combined Code 2008 throughout the year.